Invest with intelligence

NSE

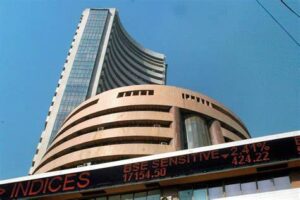

National Stock Exchange of India (NSE): A Comprehensive Overview

The National Stock Exchange of India (NSE) is the leading stock exchange in India in terms of market capitalization and turnover. Founded in 1992, it has transformed the Indian capital market by introducing modern trading practices and technology, and by providing a transparent and efficient platform for trading in various financial instruments.

History of NSE

The NSE was established in 1992 as a demutualized electronic exchange, with the aim of providing a modern and efficient trading platform for the Indian securities market. It was promoted by leading financial institutions, including the Industrial Development Bank of India (IDBI), the Life Insurance Corporation of India (LIC), and the National Stock Exchange of India Limited (NSEIL).

In November 1994, the NSE started its operations by trading in the wholesale debt market segment. It later introduced trading in equities, derivatives, and other financial instruments. Today, the NSE has a pan-India presence, with offices in major cities such as Mumbai, Delhi, Kolkata, Chennai, and Bengaluru.

Significance of NSE

The NSE has played a crucial role in the development of India’s capital market by providing a transparent and efficient platform for trading in various financial instruments. It has also helped to deepen the market by increasing the number of listed companies, introducing new financial products, and by attracting foreign investment.

One of the key features of the NSE is its electronic trading system, which provides for fast and accurate trading, and reduces the possibility of errors and manipulation. It also provides a level playing field to all investors, by ensuring that all orders are executed on a first-come, first-served basis.

The NSE is also known for its market indices, such as the NIFTY 50 and the NIFTY Bank index, which are widely used as benchmarks for the Indian equity market. The NIFTY 50 is a benchmark index of the National Stock Exchange, representing the performance of the top 50 companies listed on the exchange, based on market capitalization.

Role of NSE

The NSE plays a crucial role in the development and regulation of India’s capital market. It provides a platform for companies to raise funds through the issue of securities, and for investors to buy and sell securities. It also provides a range of services, such as clearing, settlement, and risk management, to ensure the smooth functioning of the market.

The NSE is regulated by the Securities and Exchange Board of India (SEBI), which is responsible for ensuring the transparency, fairness, and integrity of the Indian securities market. It is also subject to the rules and regulations of the Reserve Bank of India (RBI) and other regulatory bodies.

Conclusion

The National Stock Exchange of India (NSE) is a leading stock exchange in India, providing a transparent and efficient platform for trading in various financial instruments. Its electronic trading system, market indices, and other services have helped to transform the Indian capital market, and to deepen it by attracting more investors and companies. The NSE plays a crucial role in the development and regulation of India’s capital market, and is expected to continue to do so in the future.